Introduction

In India’s industrial landscape, coal remains a cornerstone. Even as renewable energy sources gain momentum, the scale, speed, and cost-structure of many heavy industries mean that coal — especially metallurgical (coking) and thermal grades — continues to play a critical role. For a company like yours operating in industrial coal supply, understanding the emerging trends and innovations is not just useful, it’s essential. Let’s explore how the sector is evolving in India, what innovations are shaping its future, and what this means for businesses engaged in coal trade, supply-chain, and industrial solutions.

1. Why Industrial Coal Supply Still Matters

- The Indian economy is growing rapidly, and industries such as steel, cement, power generation, chemicals, and heavy manufacturing continue to rely heavily on coal. According to a PWC report, coal contributes to around 70 % of India’s electricity generation and is central to meeting base-load energy demand. (PwC)

- On the metallurgical side, India aims to ramp up steel production to 300 million tonnes by 2030, which will raise demand for coking coal (used in blast furnaces). (The Times of India)

- Domestic production has grown strongly too. For instance, India’s coal production has increased by more than 70 % in the last decade. (limeinstitute.org)

- For your business in industrial coal supply, this means there is still a strong addressable market — but one undergoing change.

2. Key Trends Shaping the Coal Supply Sector

Here are several major trends in India that any coal-supply business should take note of:

a. Domestic production & import dynamics

- While India has significant coal reserves, for certain grades (especially high-quality metallurgical / washed coking coal) the dependence on imports remains high. (metalbook.com)

- However, imports are projected to decline as domestic capacity builds. For example, a report projects coking coal demand increasing from ~87 Mt in FY25 to ~135 Mt by FY30, while import reliance could drop below ~80 %. (The Times of India)

- This creates an opportunity for supply-chain players to focus on domestic sourcing, beneficiation (washing), and logistics.

b. Modernisation of logistics & supply-chain

- The launch of the “Koyla Shakti Dashboard” by the National Industrial Corridor Development Corporation (NICDC) is a major push. It uses real-time data analytics across ports, rail, mines and power plants to monitor coal flow, improving transparency and efficiency. (OpenGov Asia)

- Such initiatives reduce risk of bottlenecks, help forecasting and enable better tracking — a positive for businesses managing supply chains.

c. Technology & Mining/Processing Innovation

- Advances in mining and processing (automation, AI, remote monitoring, etc) are gaining ground in India. For example, one overview of coal-mine innovation notes India is moving toward AI-driven systems, remote sensors, and advanced environmental/monitoring protocols. (Farmonaut®)

- In steel sector-linked coking coal supply, the emphasis is also on better beneficiation (washed coal), improved blending with AI systems, etc. (metalbook.com)

d. Policy & regulatory transformation

- The Indian government has introduced several reforms to boost domestic coal supply, including auctions of coal blocks, private participation, incentives for washeries, etc. (The Times of India)

- As supply and demand evolve, regulatory clarity in logistics, mining rights, and exports/imports will matter more.

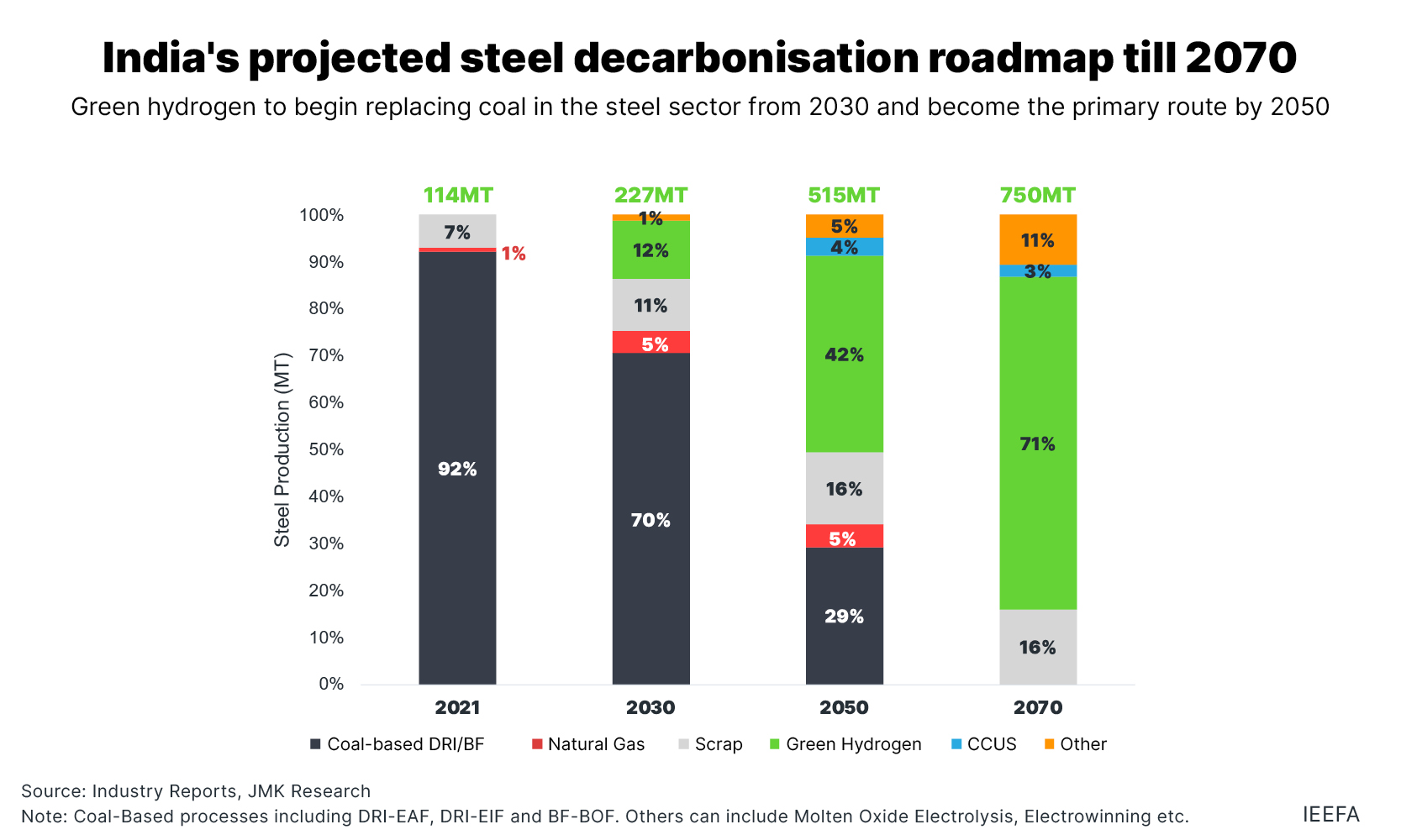

e. Sustainability & shift in energy mix

- Although coal’s relevance remains high, India’s dream of a clean energy transition is creating tension and opportunity. Coal supply chains are under increasing scrutiny for emissions, land-use, water use, etc. (PwC)

- For industrial players, this means planning for a world where low-carbon solutions matter — including cleaner coal technologies, improved efficiency, and potential links to carbon-capture or hybrid systems.

3. Innovations that Are Driving Change

Let’s look more closely at some of the innovations that coal-supply businesses and industrial coal users are adopting — and which your company should watch.

AI & Automation in Mining / Processing

Advanced analytics and machine learning are being used to optimise coal blending, predict equipment failure, improve mine safety and boost efficiency. For example, while specific Indian case-studies are emerging, the global trend indicates autonomous trucks, real-time sensor feeds, and predictive maintenance. (Farmonaut®)

Digital Supply Chain Platforms

The Koyla Shakti dashboard is one instantiation of a digital platform that integrates rail, port, logistics, mines and consumer plants. This level of integration helps with real-time visibility, tracking stock positions, identifying bottlenecks, and can reduce idle inventory or logistics delays. (OpenGov Asia)

Washed Coal / Beneficiation Technology

As India moves to reduce dependency on imports of high-grade coking coal, washeries (coal-washing plants) are becoming more important. According to reports, India’s washed coking-coal output remains low (7-8 Mt per annum), and rising this will help reduce imports. (metalbook.com)

Alternate Routing & Diversified Imports

While domestic supply is growing, import sources and logistics are also changing. India is diversifying beyond Australia—for example, to the US, Russia, Indonesia—to reduce supply risk and cost. (metalbook.com)

Sustainability Integration

Mining projects are adding environmental monitoring, methane capture, land-rehabilitation, and integrating renewable energy to power operations. While not yet replacing coal, these innovations improve the sustainability profile and can help access financing and contracts in a greener supply-chain. (Farmonaut®)

4. Implications for Industrial Coal-Supply Businesses

Given these trends and innovations, here are some implications and strategic considerations for your business (e.g., if you’re supplying industrial coal, trading, logistics or integrating with industrial users):

Opportunity areas

- Domestic sourcing & beneficiation: Since the government is pushing for more domestic high-grade coal supply, investing (or partnering) in washeries or beneficiation plants can open up upward margin opportunities.

- Logistics & supply-chain services: The move to digital dashboards and real-time tracking means those who can offer efficient rail/port/stock management services will differentiate.

- Value-added services for industrial users: For industries (power, steel, chemicals), value-added services like coal-quality testing, blending services, just-in-time delivery, logistics optimisation will create stickiness.

- Diversified import networks: While domestic production is rising, imports will remain important. Can you build networks for alternative sources (Indonesia, US, Russia) with logistics flexibility?

- Sustainability credentials: Industrial buyers increasingly favour suppliers with better ESG credentials. Offering “washed coal”, lower-ash coal, or linking to carbon-efficient logistics can be a differentiator.

Challenges to watch

- Quality constraints: Domestic coal often has higher ash content or lower grade compared to imports—so meeting industrial specifications can be difficult. (metalbook.com)

- Regulatory & land-use delays: Mining, washing plants, logistics corridors still face ecosystem delays—clearances, land acquisition, environmental issues.

- Energy-transition risk: As renewables grow, and as industries push to decarbonise, demand for certain coal grades may change. Long-term contracts will need flexibility.

- Logistics bottlenecks: Rail/port capacity constraints, stockpile issues, or delays can raise costs significantly—so reliability is key.

- Price volatility & global competition: Import coal prices, freight costs, exchange rates all affect competitiveness—so you’ll need robust risk-management.

5. The Road Ahead: What to Watch in the Next 5-10 Years

- By 2030, demand for coking coal in India could reach ~135 Mt (from ~87 Mt today) as steel capacity expands. (The Times of India)

- The government’s push for “atmanirbhar” coal (self-reliant) means more domestic blocks being auctioned, washeries being incentivised, and private participation increasing. This could tilt the balance toward domestic supply.

- Digital supply-chain platforms (like Koyla Shakti) will become more common, meaning end-to-end visibility from mine to furnace will be expected.

- Hybrid models: Coal supply businesses might increasingly integrate with logistics, warehousing, blending services, and even downstream industrial users (for example, captive coal for steel or cement).

- ESG will be a larger factor: Buyers will want lower-ash coal, reliable delivery, minimal supply disruptions, and traceability. Those who can deliver on these fronts will have an edge.

- While renewable uptake is growing fast, coal is unlikely to vanish quickly in India’s heavy-industry context. Thus, coal-supply businesses still have a multi-decade horizon—but must evolve.

6. How Businesses Like Yours Can Position for Growth

Given your company (supplying industrial coal, trade & supply-chain solutions) here are actionable strategic moves:

- Build upstream partnerships: Form alliances with domestic mines or coal-block holders to secure feedstock rather than just trading.

- Invest in beneficiation/logistics infrastructure: If possible, invest or collaborate in washeries, stockyards, blending units to improve quality and margins.

- Offer integrated supply-chain solutions: Provide not just coal but delivery-to-plant services, quality testing, scheduling, just-in-time logistics — this increases your value proposition.

- Focus on niche high-spec grades: For industrial users (steel, chemicals) who need specific grades (washed coking coal, low ash thermal), focus on delivering those reliably.

- Leverage digital & data-capabilities: Use dashboards, real-time tracking, predictive logistics to reduce delivery time, manage stock levels, minimise disruptions.

- Highlight sustainability credentials: Attract customers by demonstrating lower-ash coal, efficient transport, compliant operations — this helps in contracts and premium pricing.

- Monitor regulatory shifts: Auctions, export/import policies, logistics reforms will affect supply cost and risk. Stay ahead.

- Diversify import-feed when necessary: Even with good domestic supply, maintain flexibility to tap imports when grade or cost advantages exist.

Conclusion

The industrial coal-supply landscape in India is undergoing a transformation — not overnight displacement, but significant evolution. For businesses like yours, the key is to adapt and innovate: shifting from pure trade to integrated supply-chain solutions, leveraging digital tools, focusing on quality and sustainability, and aligning with policy shifts and industrial demand. By doing so, you can turn the trends and innovations in India’s coal sector into a strategic advantage rather than a risk.